Mortgage calculator with escrow and extra payments

Homeowners who have experienced a financial hardship who took out a mortgage on or before January 1 2009. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

Extra Payment Calculator Is It The Right Thing To Do

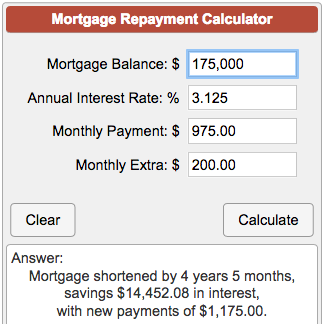

If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan.

. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Make a mortgage payment get info on your escrow submit an. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

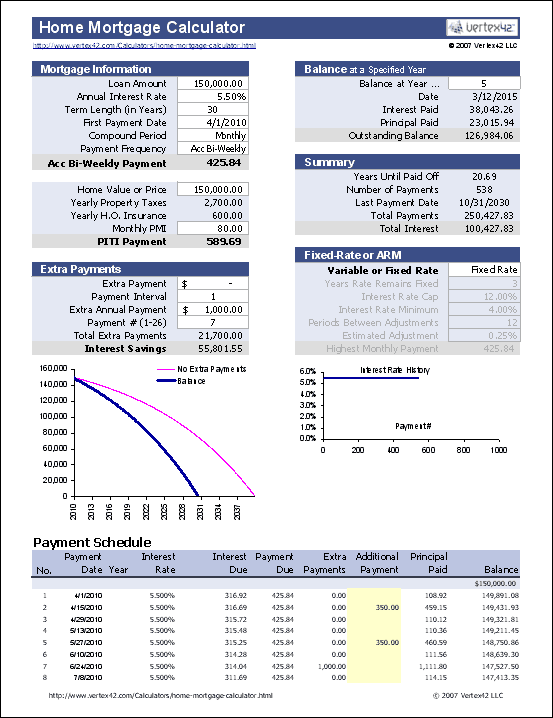

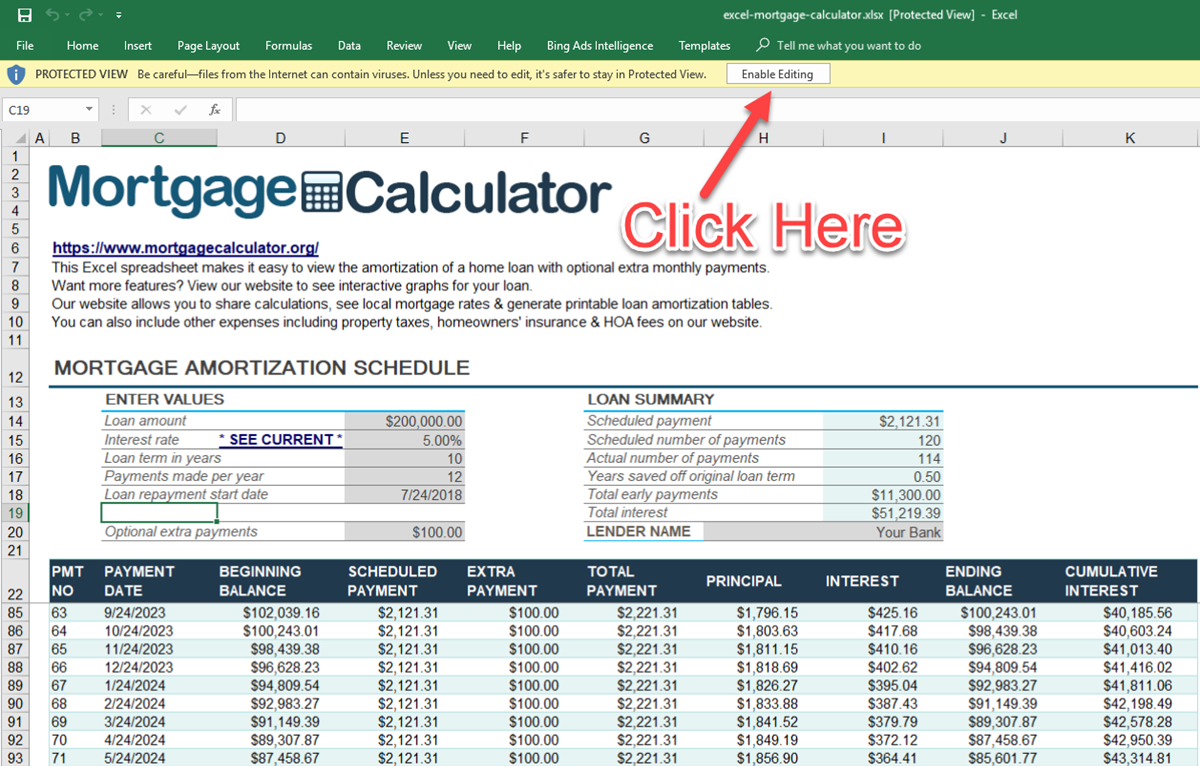

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. You can set up periodic extra payments or add additional payments manually within the Payment ScheduleUse the spreadsheet to compare different term lengths rates loan amounts and the savings from making extra. Account for interest rates and break down payments in an easy to use amortization schedule.

The calculators results page will return a loan option best fit for your needs including the length projected rates. Lenders often roll property taxes into borrowers monthly mortgage bills. Homeowners must have mortgage loans insured by CalHFA Mortgage Insurance on or before May 31 2009.

Our calculator includes amoritization tables bi-weekly savings. CalHFA Mortgage Insurance Services HARP Eligible Program. Found on the Set Dates or XPmts tab.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. How to Use the Mortgage Calculator. Shows total interest paid.

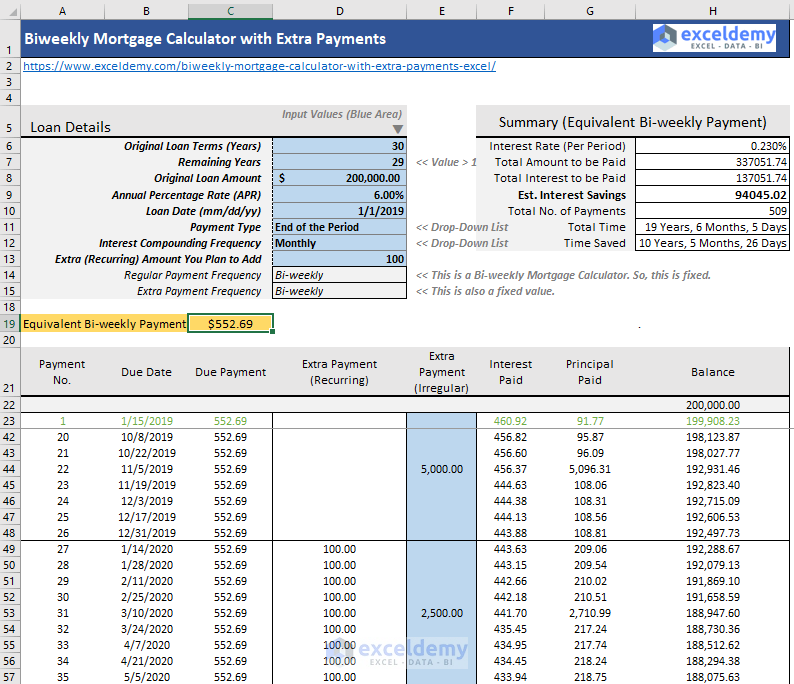

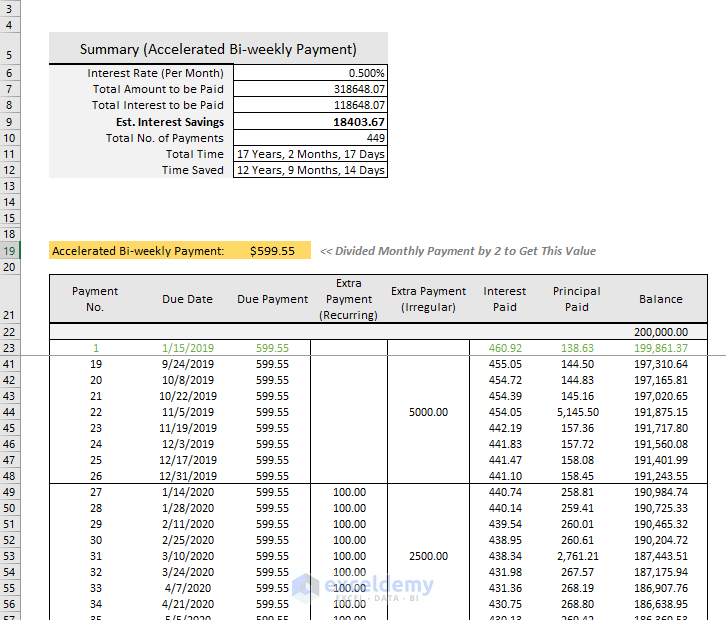

P Principal Amount initial loan balance i Interest Rate. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. Biweekly paymentsThe borrower pays half the monthly payment every two weeks.

Mortgage Payoff Calculator Cost of Living Calculator. Use our free mortgage calculator to estimate your monthly mortgage payments. M Monthly Payment.

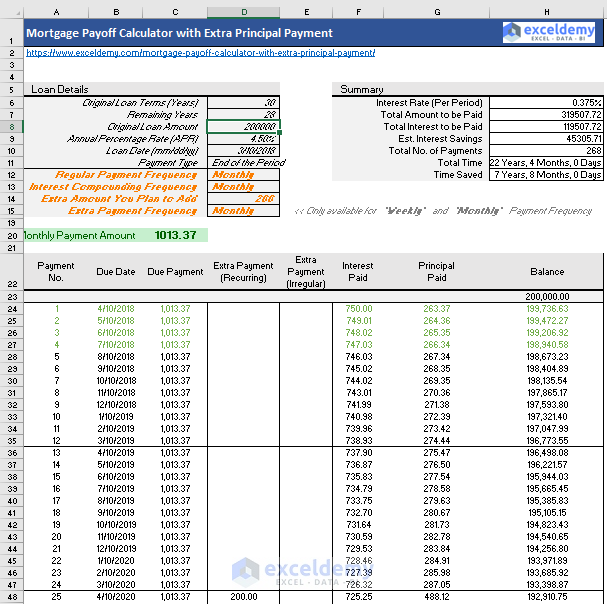

If you own real estate and are considering making extra mortgage payments the early mortgage payoff calculator below could be helpful in determining how much youll need to pay and when to meet a certain financial goal. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. N How many payments youll make over the life of the loan For a 30-year mortgage thats 360 payments.

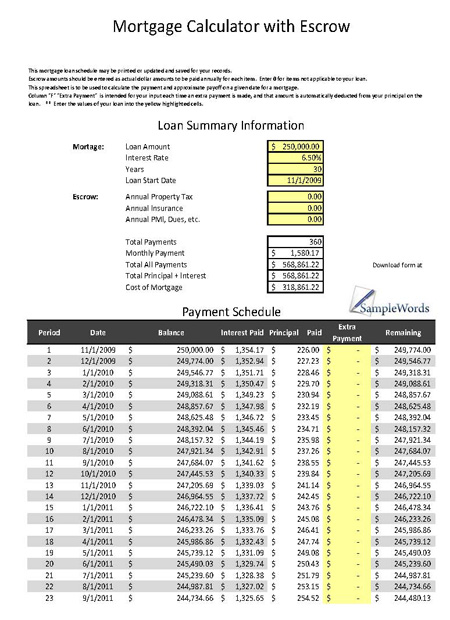

Your mortgage can require. The Math Behind Our Mortgage Calculator. At closing buyers are often required to open an ongoing escrow account from which their mortgage servicer will pay ongoing costs.

The calculator updates results automatically when you change. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Your lender will manage the escrow account and submit payments for your property taxes and homeowners insurance when they are due.

It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. To determine how much property tax you pay each month lenders. Our Excel mortgage calculator spreadsheet offers the following features.

Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Whatever the frequency your future self will thank you. Youre probably familiar with refinancing but you may not have heard about mortgage recastingWhen recasting you make one large lump-sum payment toward your principal.

This Excel spreadsheet is an all-in-one home mortgage calculatorIt lets you analyze a fixed or variable rate home mortgage. A title for these calculator results that will help you identify it if you have printed out several versions of the calculator. First Payment Due - due date for the first payment.

As some lending institutions will escrow the extra payments and only apply them at the end of the mortgage. An escrow account is free to open or maintain because its a requirement for loans with less than 20 down. While private lenders who offer conventional loans are usually not required to do that the FHA requires all of its borrowers to pay taxes along with their monthly mortgage payments.

Escrow deposit for property taxes andor mortgage insurance. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Its a great.

With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage. Allows extra payments to be added monthly. Enter your loan information and find out if it makes sense to add additional payments each month.

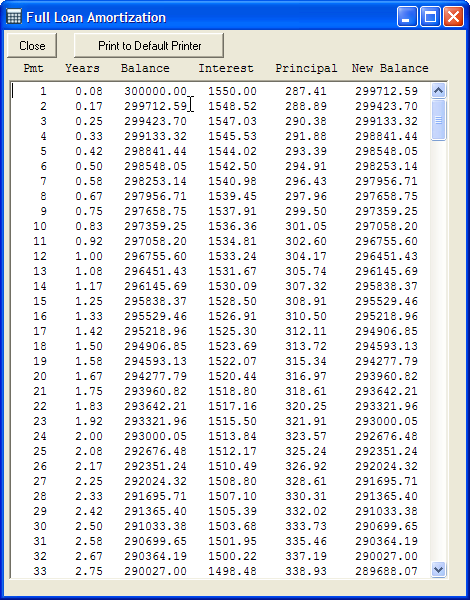

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. This free online mortgage amortization calculator with extra payments will calculate the time and interest you will save if you make multiple one-time lump-sum weekly quarterly monthly andor annual extra payments on your house loan. The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months.

Our mortgage calculator can help you determine what mortgage you can afford by taking simple information about your finances and prospective home to predict your monthly payments including your principal and interest rate. Mortgage Closing Date - also called the loan origination date or start date. A mortgage in itself is not a debt it is the lenders security for a debt.

Extra Payments In The Middle of The Loan Term. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use.

N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage. Field Help Input Fields. 30 years x 12 months per year From here you can find out your total monthly payment by adding in any other fees including the monthly payment amount for taxes and insurance find their annual costs and divide by 12 HOA or condo.

Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. There are optional inputs in the Mortgage Calculator to include many extra payments and it can be helpful to compare the results of supplementing mortgages with or without extra payments. Make more frequent payments.

Paying Taxes With a Mortgage. For example if you are 35 years into a 30-year home loan you would set the loan term to 265. Churchill will cut the seller a check for 5000.

Lowers monthly mortgage payments so that theyre more affordable. Check out the webs best free mortgage calculator to save money on your home loan today. This gives the seller extra confidence in picking your offer over the competitions.

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

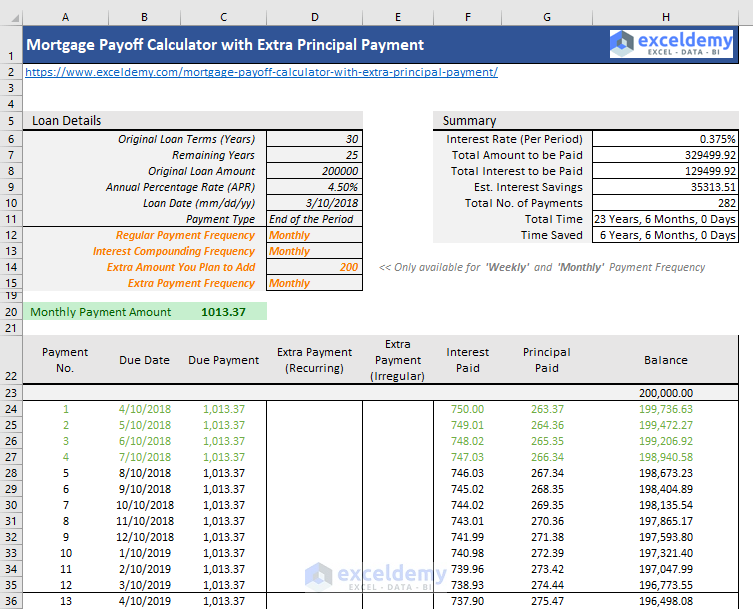

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator With Escrow Excel Spreadsheet

Mortgage Payoff Calculator With Extra Principal Payment Free Template

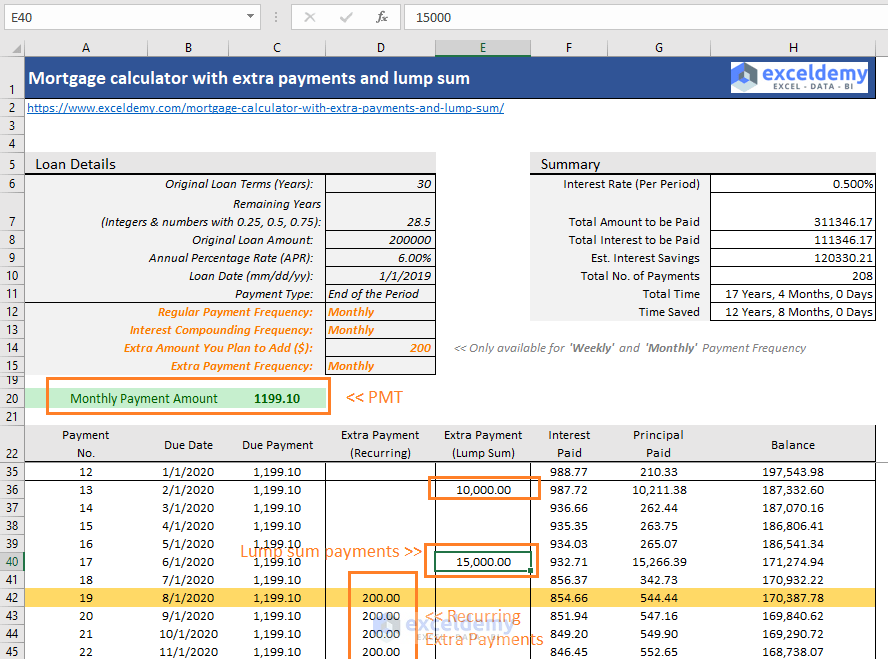

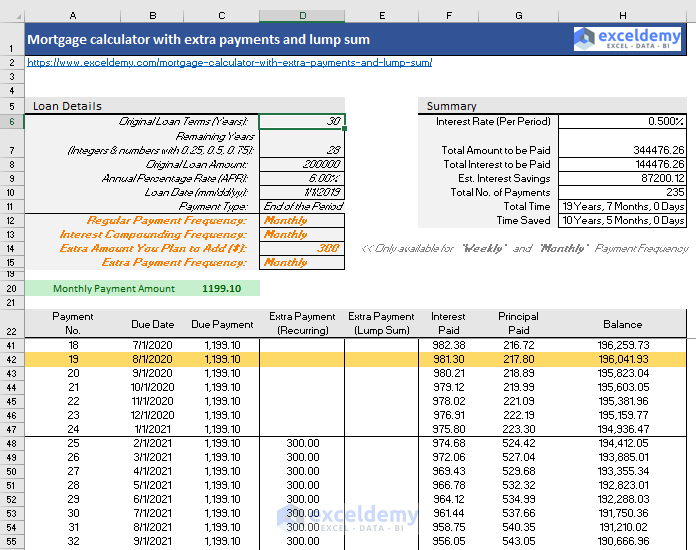

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

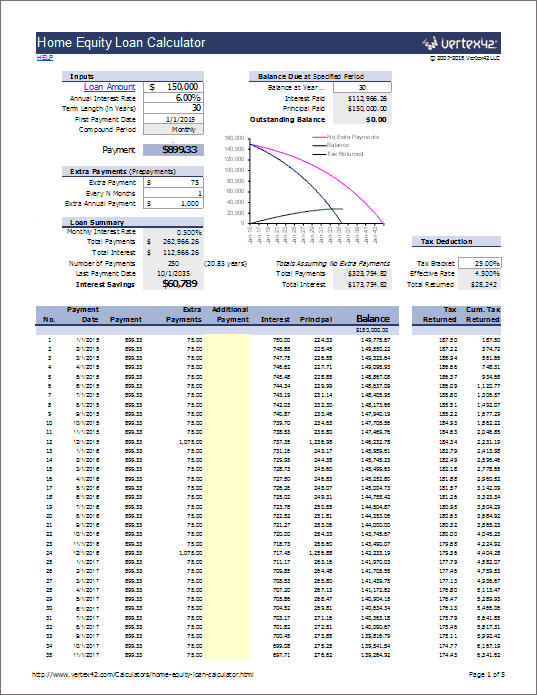

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Repayment Calculator

Downloadable Free Mortgage Calculator Tool

Free Financial Calculators For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Downloadable Free Mortgage Calculator Tool

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Komentar

Posting Komentar